When it comes to buying a home, understanding the mortgage process is crucial. To help you navigate through the complexities of securing a mortgage, we have created a comprehensive flow chart that outlines the steps involved in obtaining a home loan. Read on to learn more about the mortgage process flow chart and how it can help you achieve your dream of homeownership.

The first step in the mortgage process is pre-qualification. During this stage, you will provide your financial information to a lender who will assess your creditworthiness and determine how much you can afford to borrow. This will give you a better idea of your budget and help you narrow down your home search. Once you are pre-qualified, you can start looking for homes within your price range.

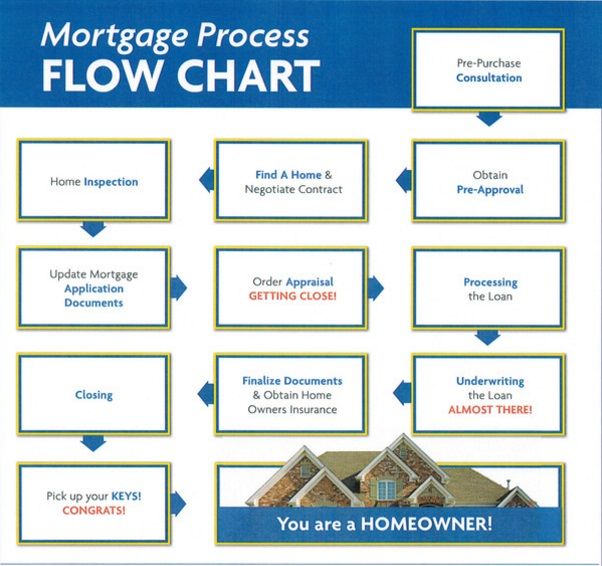

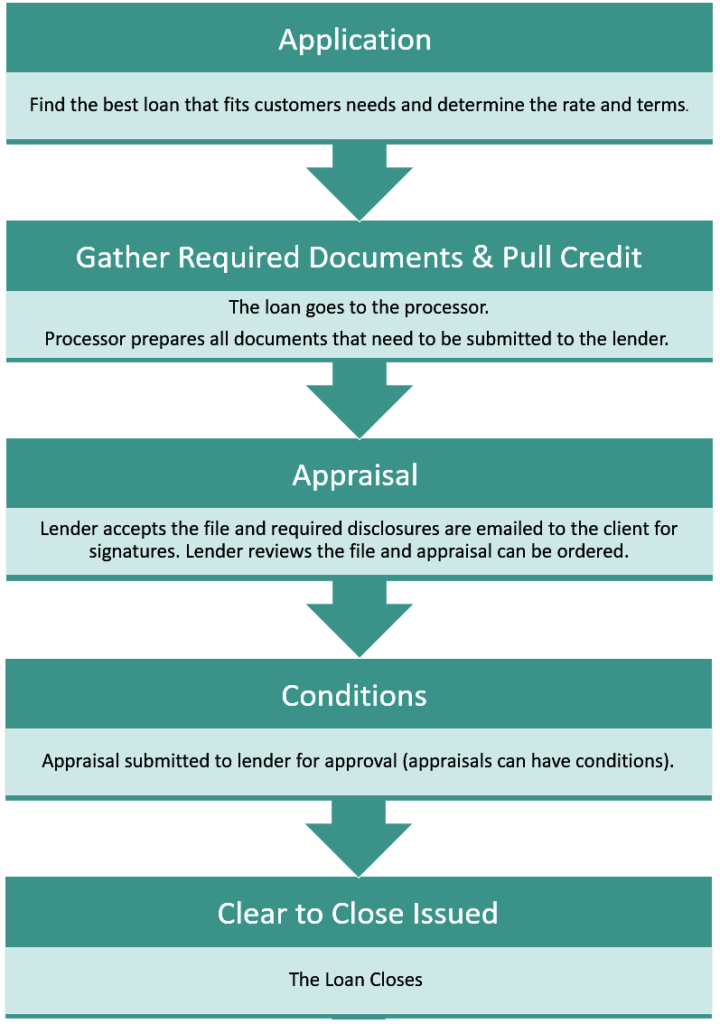

Mortgage Process Flow Chart

Step 2: Loan Application

Once you have found a home that you would like to purchase, you will need to complete a loan application. This involves providing detailed information about your income, assets, debts, and the property you wish to buy. The lender will then review your application and determine whether you meet the necessary requirements for a mortgage. If approved, you will receive a loan estimate outlining the terms of the loan, including interest rates, closing costs, and monthly payments.

Step 3: Underwriting and Approval

After submitting your loan application, the lender will conduct a thorough review of your financial documents and the property you wish to purchase. This process is known as underwriting. The underwriter will assess your creditworthiness, employment history, and financial stability to determine whether you are a good candidate for a mortgage. If everything checks out, you will receive final approval for your loan, and you can move forward with the closing process.

Step 4: Closing

Once your loan has been approved, you will attend a closing meeting to sign the necessary paperwork and finalize the purchase of your home. During the closing process, you will pay any remaining fees and closing costs, and the lender will transfer the funds to the seller. Once all documents have been signed and funds have been exchanged, you will officially become a homeowner.

Conclusion

Securing a mortgage can be a complex and daunting process, but with the help of a mortgage process flow chart, you can better understand the steps involved and ensure a smooth and successful home buying experience. By following the steps outlined in this guide, you can navigate through the mortgage process with confidence and achieve your goal of homeownership.

Download Mortgage Process Flow Chart

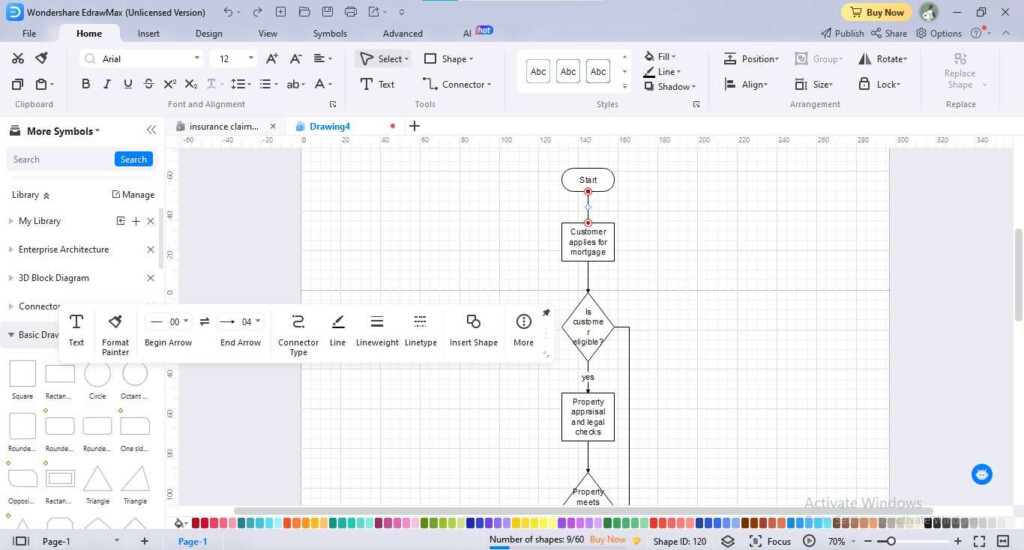

Mortgage Process Flow Charts Uses Examples And Creation

Mortgage Process Flow Charts Uses Examples And Creation

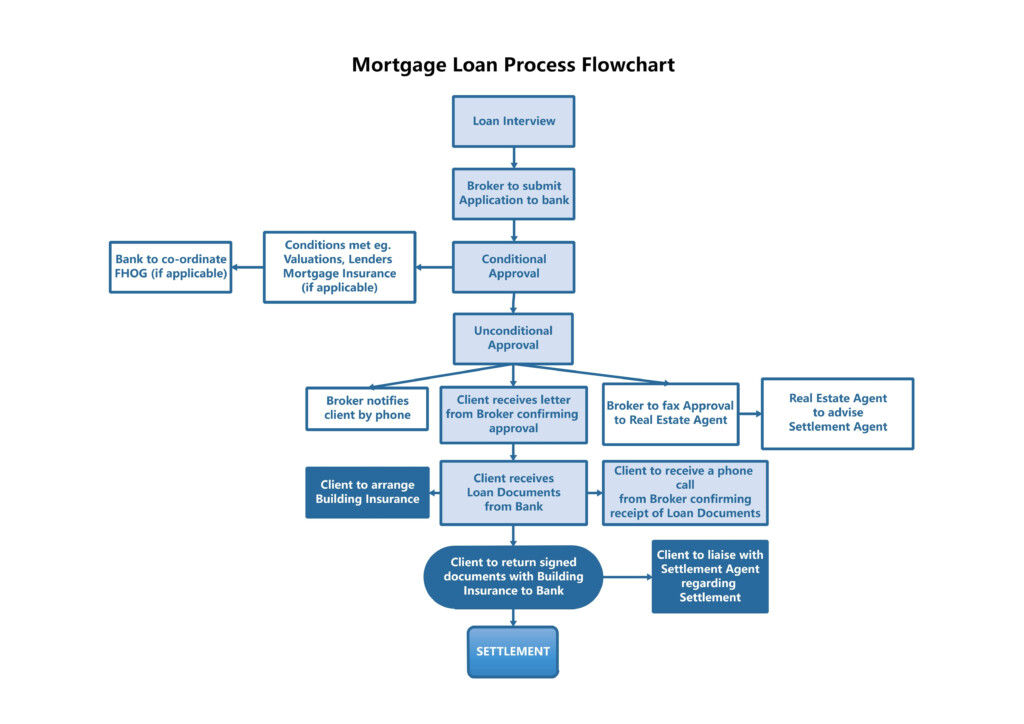

Mortgage Origination Process Flow Chart

Loan Process Flow Chart Colorado Mortgage Broker