A financial system is a network of institutions, markets, and intermediaries that facilitate the flow of funds between savers and borrowers. The financial system plays a crucial role in the economy by allocating resources efficiently, providing liquidity, and reducing risk. A flow chart of the financial system visually represents how funds move through various components of the system.

1. Savers: Individuals, businesses, and governments that have excess funds and are looking to invest or save for the future.

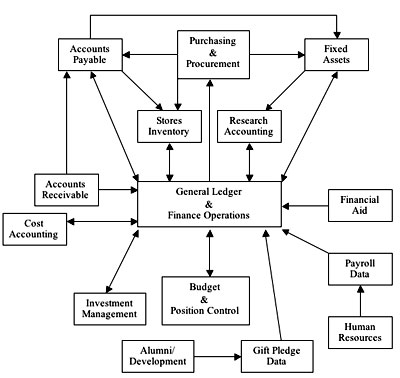

Flow Chart Of Financial System

2. Financial Intermediaries: Institutions such as banks, insurance companies, and mutual funds that channel funds from savers to borrowers.

3. Financial Markets: Platforms where savers and borrowers come together to buy and sell financial assets such as stocks, bonds, and commodities.

4. Central Bank: The regulatory authority that oversees the financial system, sets monetary policy, and acts as a lender of last resort.

5. Government: Sets regulations and policies that govern the financial system and ensure its stability and integrity.

Importance of Understanding Financial System Flow Chart

By understanding the flow chart of the financial system, individuals and businesses can make informed decisions about investing, saving, and borrowing. It helps them navigate the complex network of financial institutions and markets, identify opportunities for growth, and manage risks effectively. Moreover, policymakers can use the flow chart to monitor the health of the financial system, detect potential vulnerabilities, and implement measures to prevent crises.