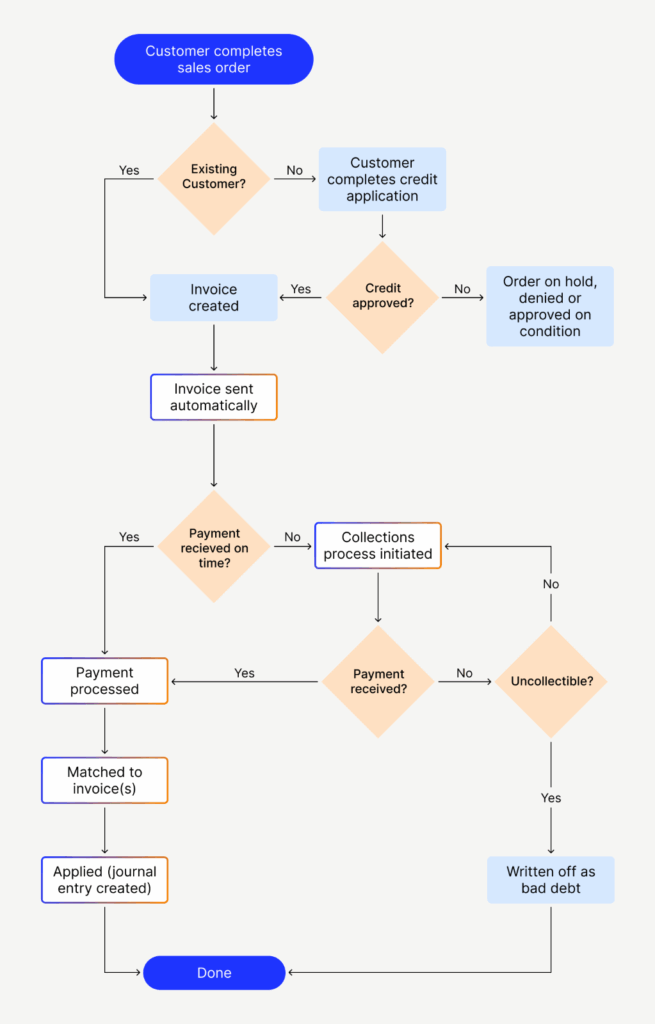

Managing accounts receivable is crucial for any business to maintain healthy cash flow and ensure timely payments from customers. An accounts receivable process flow chart serves as a visual representation of the steps involved in managing and tracking invoiced amounts. By having a clear and structured flow chart in place, businesses can streamline their collections process, reduce errors, and improve overall efficiency.

Creating an accounts receivable process flow chart can help businesses identify bottlenecks in the invoicing and collections process, allowing them to take corrective actions to improve cash flow. It also serves as a valuable tool for training new employees on the steps involved in managing accounts receivable, ensuring consistency and accuracy in handling customer payments.

Accounts Receivable Process Flow Chart

Key Steps in an Accounts Receivable Process Flow Chart

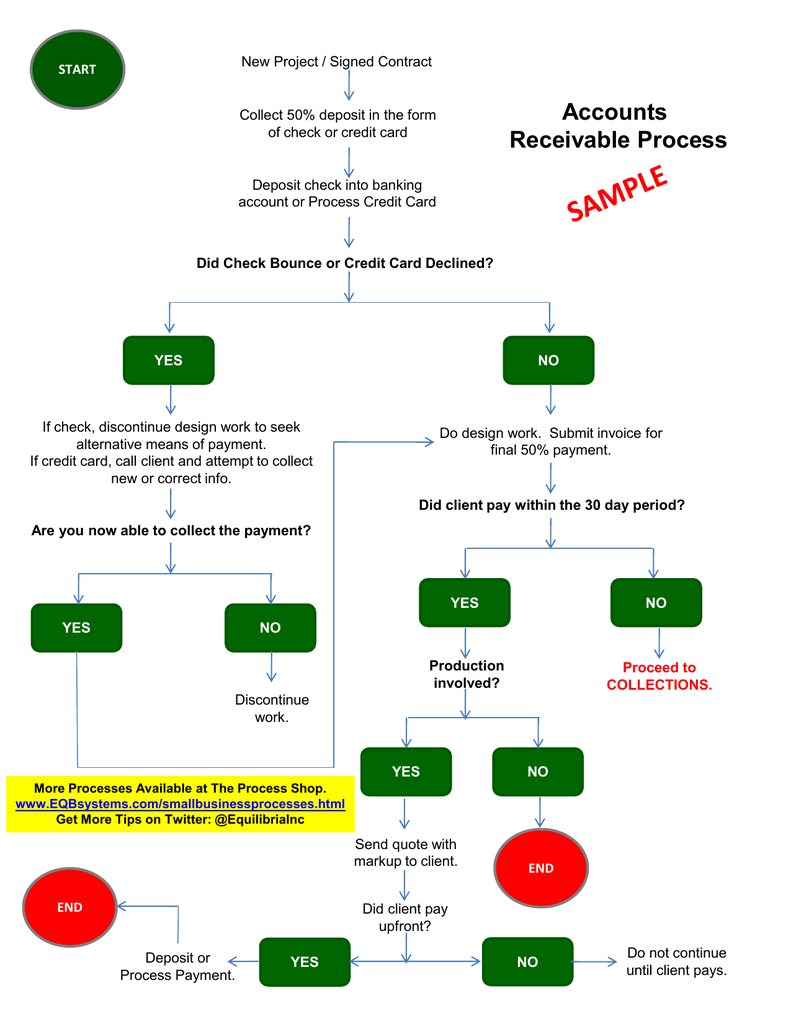

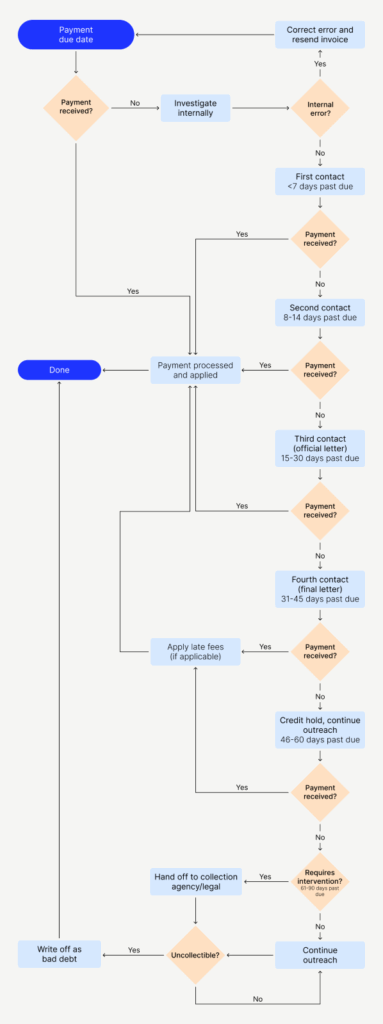

The first step in the accounts receivable process flow chart is the generation of invoices for goods or services provided to customers. Once the invoices are sent out, businesses need to track and monitor payments received against each invoice. This involves reconciling payments with outstanding invoices and following up with customers for any overdue payments.

Another key step in the process flow chart is the management of customer accounts, which includes updating customer information, setting credit limits, and resolving any disputes or discrepancies in payments. Businesses also need to have a system in place for recording and reconciling payments, whether through cash, check, credit card, or electronic transfers, to ensure accurate and up-to-date financial records.

Benefits of Using an Accounts Receivable Process Flow Chart

Having an accounts receivable process flow chart can help businesses improve their collections process by providing a clear roadmap for handling invoiced amounts. It can also help businesses identify areas for improvement and implement best practices to streamline their accounts receivable operations.

By using a structured and well-defined accounts receivable process flow chart, businesses can reduce errors, minimize delays in payments, and improve overall efficiency in managing customer accounts. This can ultimately lead to better cash flow management, increased profitability, and a stronger financial position for the business.

Download Accounts Receivable Process Flow Chart

Accounts Receivable Process Flow Chart Guide Versapay 43 OFF

Accounts Receivable Process Flow Chart NBKomputer

Accounts Receivable Process Flow Chart NBKomputer

Accounts Receivable Process Flow Chart Guide Versapay 51 OFF