Managing your business’s cash flow is crucial for its long-term success. A cash flow projection chart is a powerful tool that helps you anticipate and track the movement of money in and out of your business. By creating a cash flow projection chart, you can better understand your financial position, identify potential cash shortages or surpluses, and make informed decisions to ensure your business’s financial stability.

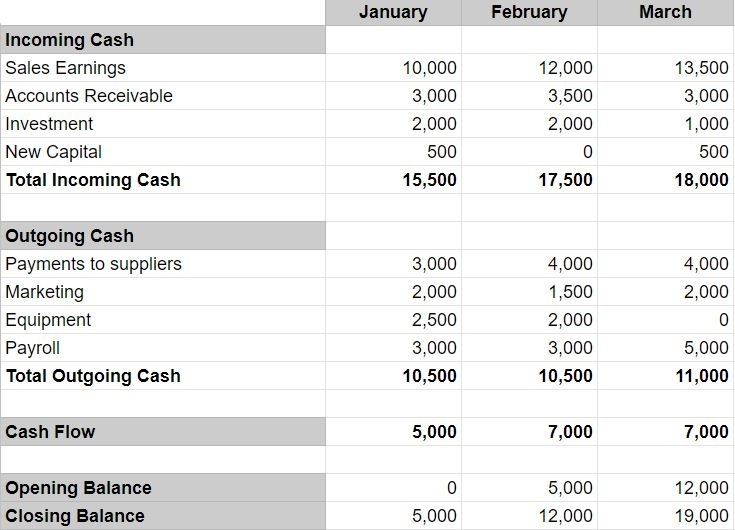

When creating a cash flow projection chart, it’s important to consider both your incoming and outgoing cash flows. Start by listing all sources of income, such as sales revenue, investments, and loans. Next, outline all expenses, including rent, utilities, payroll, and other operating costs. By categorizing and estimating the timing of these cash flows, you can create a detailed projection of your business’s cash position over a specific period, typically months or quarters.

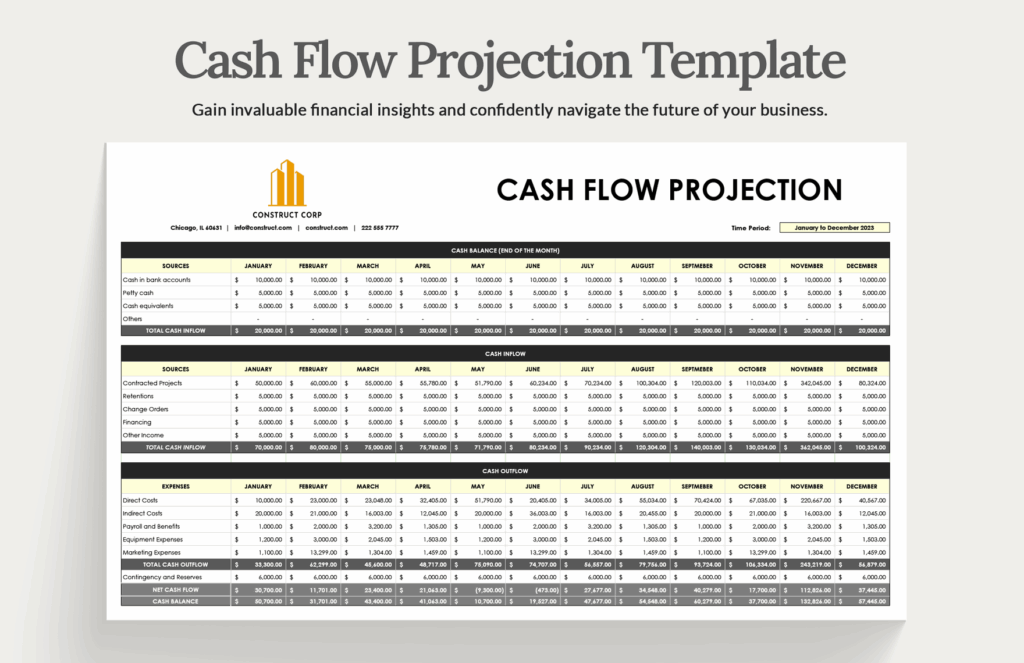

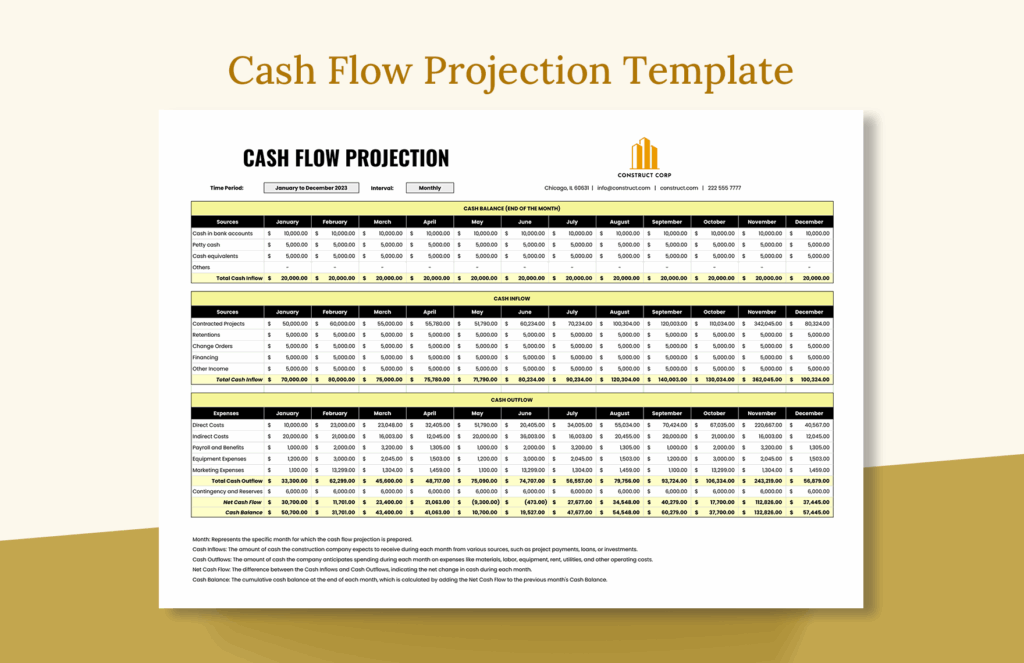

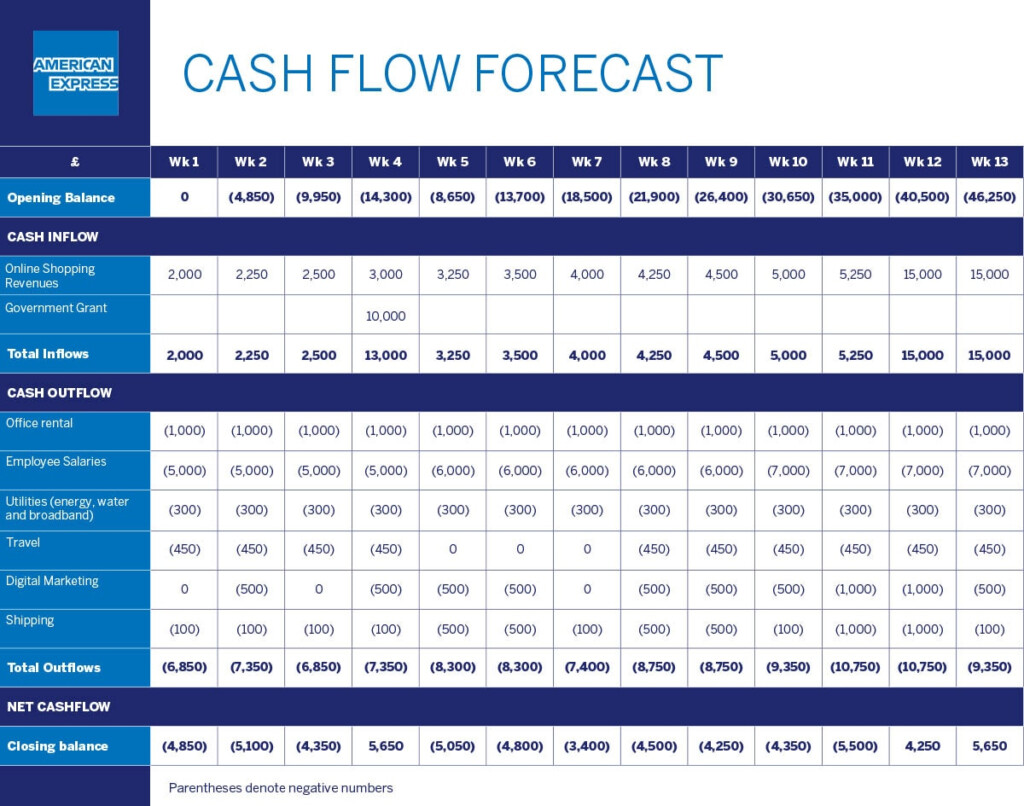

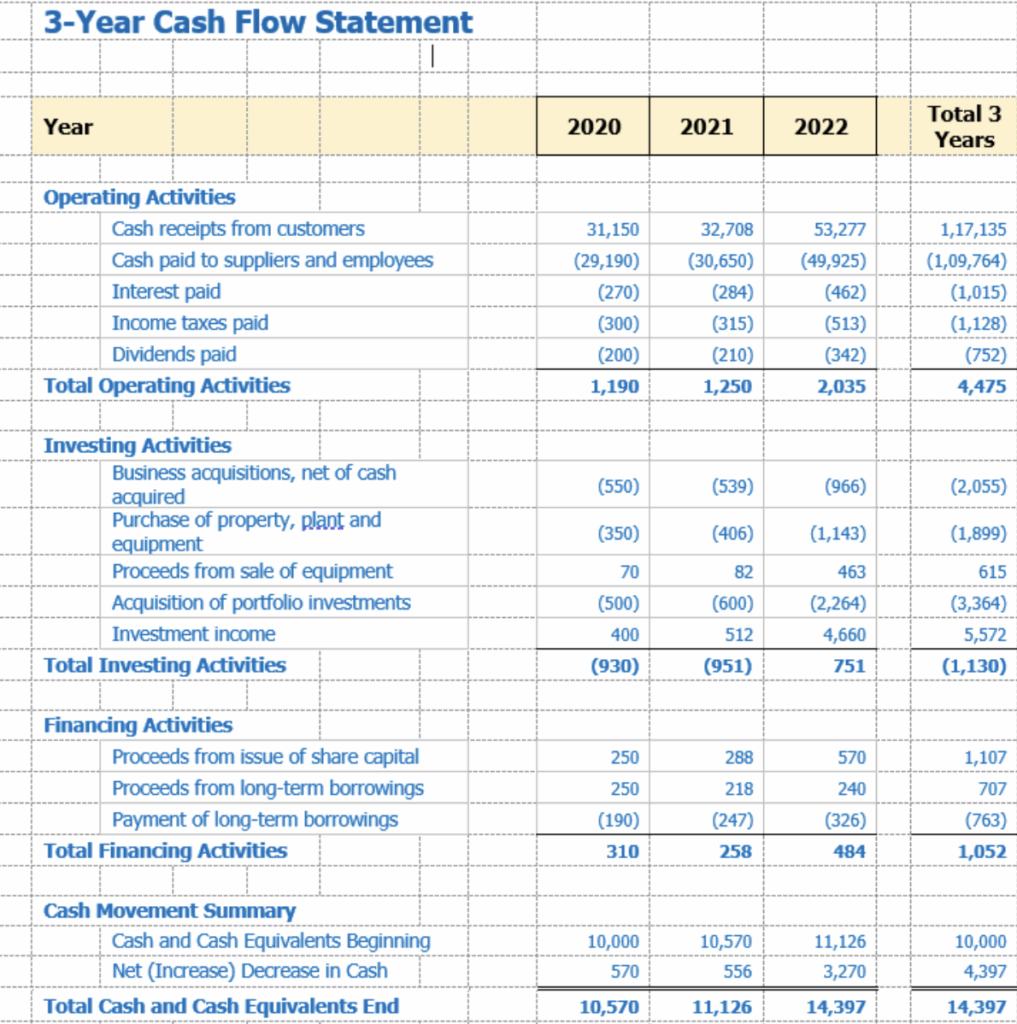

Cash Flow Projection Chart

Benefits of Using a Cash Flow Projection Chart

There are several benefits to using a cash flow projection chart in your financial planning process. Firstly, it can help you identify potential cash shortages or surpluses in advance, allowing you to take proactive measures to address any financial gaps. By monitoring your cash flow regularly, you can also spot trends and patterns that may impact your business’s financial health.

Additionally, a cash flow projection chart can help you make more informed decisions about spending, investing, and financing. By having a clear picture of your expected cash inflows and outflows, you can prioritize expenses, allocate resources effectively, and plan for future growth. This can ultimately lead to improved financial management and increased profitability for your business.

Tips for Creating an Effective Cash Flow Projection Chart

When creating a cash flow projection chart, it’s important to be realistic and conservative in your estimates. Factor in any potential changes in market conditions, customer behavior, or economic trends that may impact your cash flow. It’s also helpful to update your projection regularly based on actual financial data to ensure its accuracy.

Furthermore, consider using accounting software or financial tools to automate the process of creating and updating your cash flow projection chart. These tools can help streamline your financial planning process, improve accuracy, and provide valuable insights into your business’s cash flow dynamics. By leveraging technology, you can make better-informed decisions and drive financial success for your business.

Download Cash Flow Projection Chart

Cash Flow Projection Template Download In Excel Google Sheets

Cash Flow Projection Chart How To Create A Cash Flow Vrogue co

Cash Flow Projection Chart How To Create A Cash Flow Vrogue co

Cash Flow Projection Chart Cash Flow Template Projection Statement