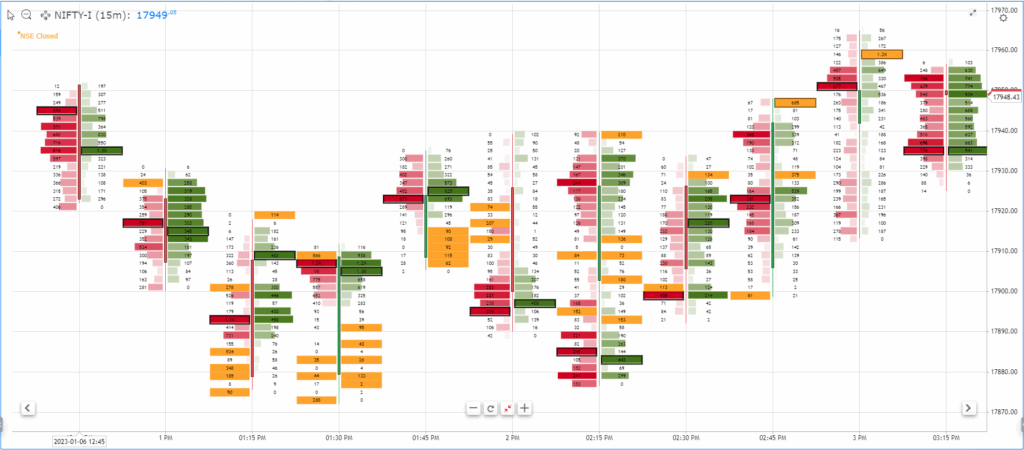

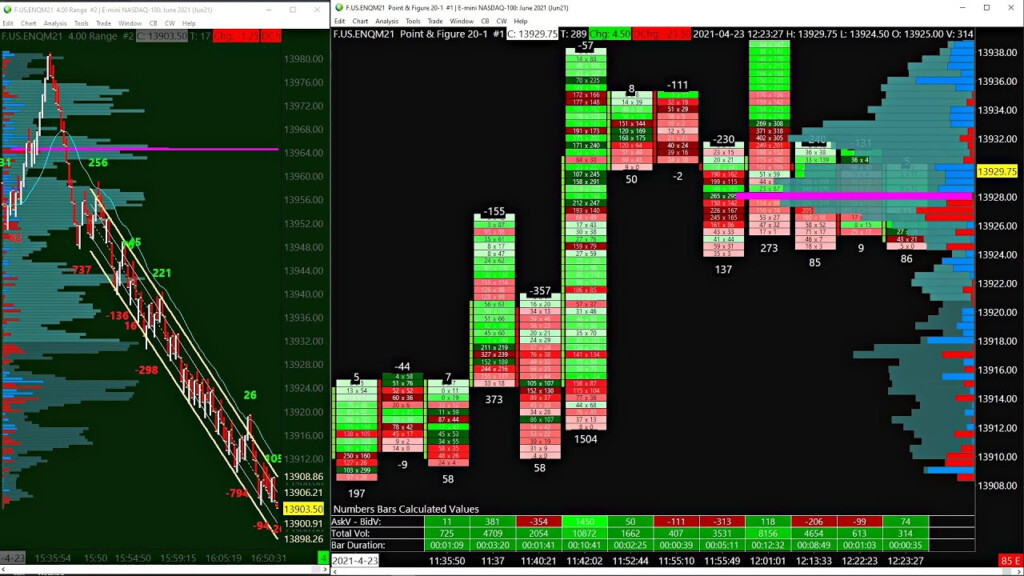

Order flow distribution refers to the analysis of the volume of buy and sell orders at various price levels in a financial market. By studying order flow distribution, traders can gain valuable insights into market sentiment and potential price movements. This information can help traders make more informed trading decisions and identify potential trading opportunities.

Charts that display order flow distribution typically show a visual representation of the volume of buy and sell orders at different price levels. These charts can help traders identify key support and resistance levels, as well as areas where there is a concentration of buying or selling pressure. By understanding order flow distribution, traders can anticipate potential price movements and adjust their trading strategies accordingly.

Chart Order Flow Distribution

How to Interpret Chart Order Flow Distribution

When analyzing chart order flow distribution, traders should pay attention to areas where there is a significant concentration of buy or sell orders. These areas can act as key support or resistance levels, where price is likely to encounter buying or selling pressure. Traders can use this information to set stop-loss levels, take profit targets, or identify potential entry points for trades.

Additionally, traders should look for areas where there is a divergence between price movement and order flow distribution. For example, if price is moving higher but there is a decrease in buying volume, this could be a sign of weakening bullish momentum. Conversely, if price is moving lower but there is an increase in buying volume, this could indicate a potential reversal in the market. By combining price action analysis with order flow distribution, traders can make more accurate predictions about future price movements.

Conclusion

Chart order flow distribution is a valuable tool for traders looking to gain insights into market sentiment and potential price movements. By analyzing the volume of buy and sell orders at different price levels, traders can identify key support and resistance levels, as well as areas of buying or selling pressure. This information can help traders make more informed trading decisions and improve their overall trading performance.

By understanding how to interpret chart order flow distribution, traders can anticipate potential price movements and adjust their trading strategies accordingly. By combining order flow distribution analysis with price action analysis, traders can gain a more comprehensive understanding of market dynamics and make more accurate predictions about future price movements.

By incorporating chart order flow distribution into their trading strategies, traders can gain a competitive edge in the financial markets and increase their chances of success.

Download Chart Order Flow Distribution

Sierra Chart Order Flow Sierra Chart Trading Flow Order Platform

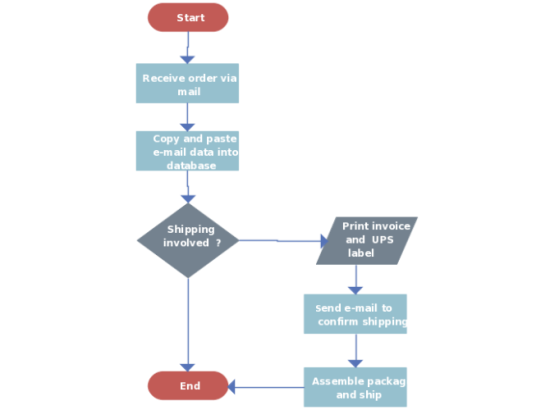

Flow Chart Of Order Processing With Shipping Computers Hub

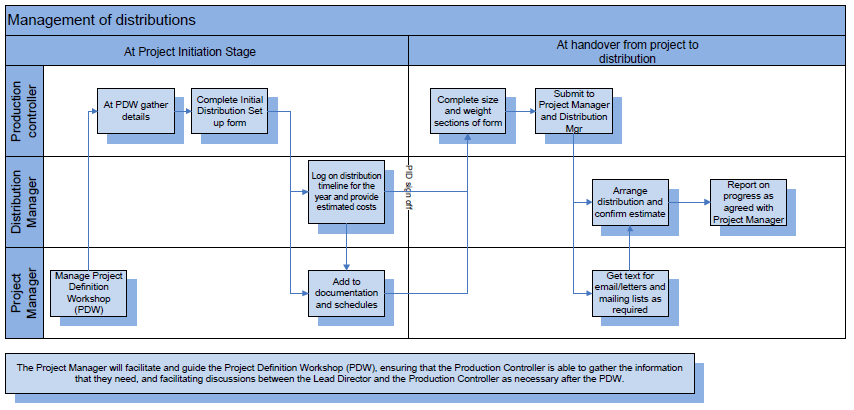

Distribution Process Flowchart

Order Flow Chart Flow Chart Work Flow Chart Flow Chart Template Images