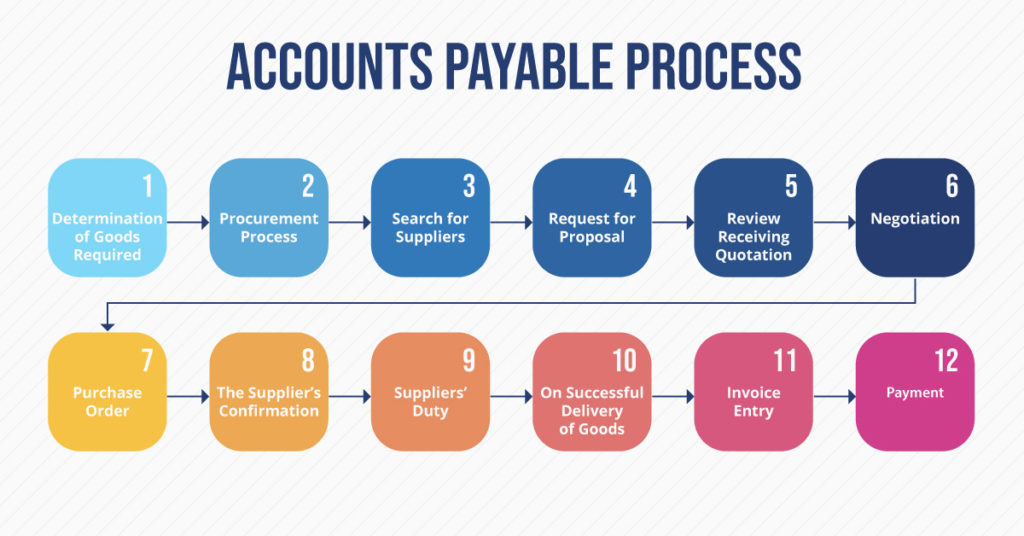

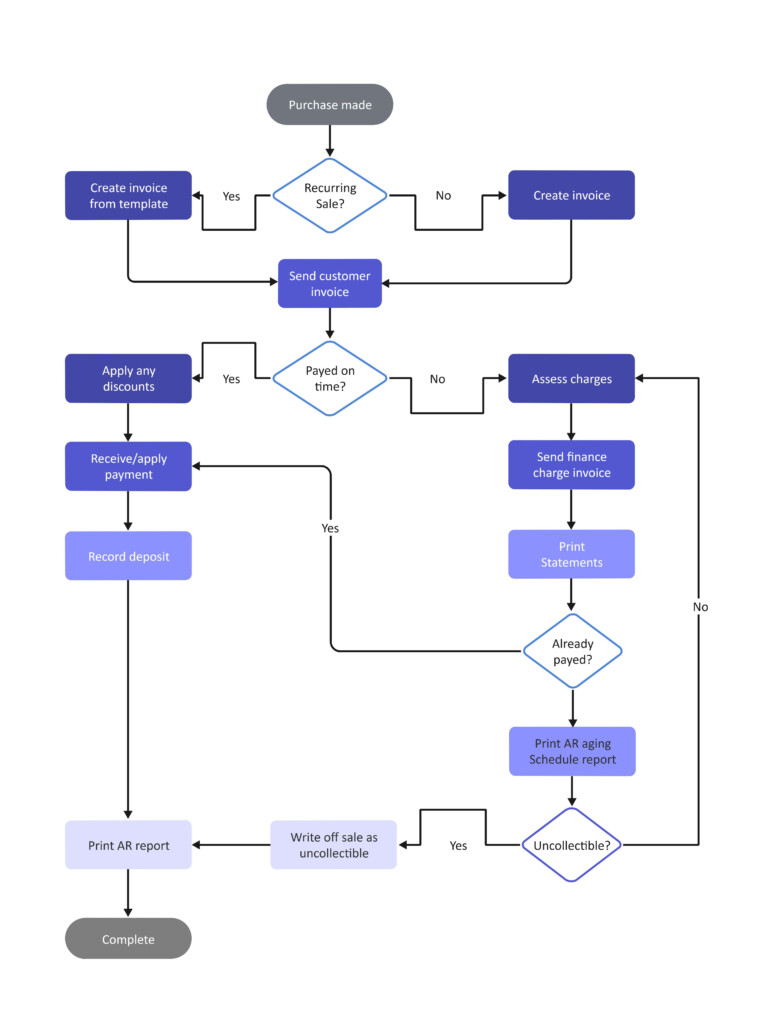

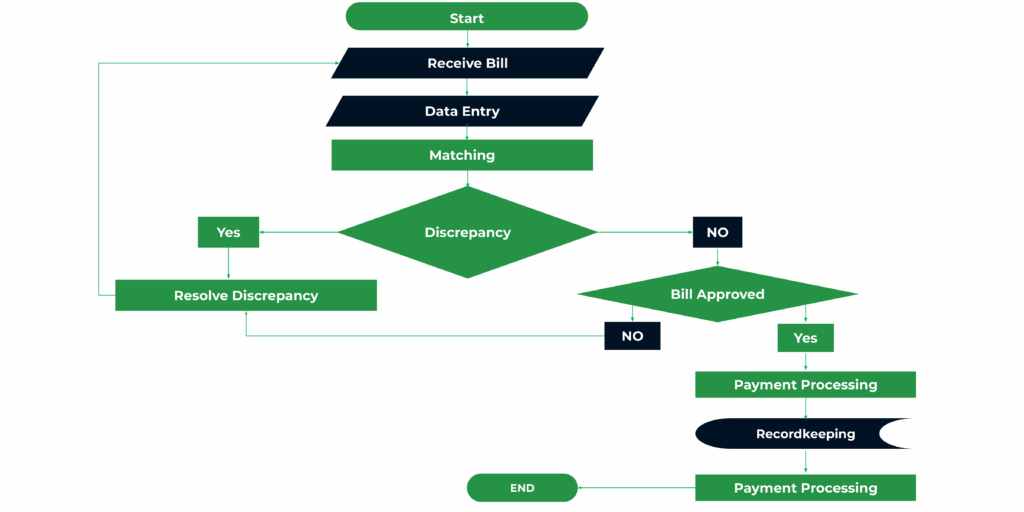

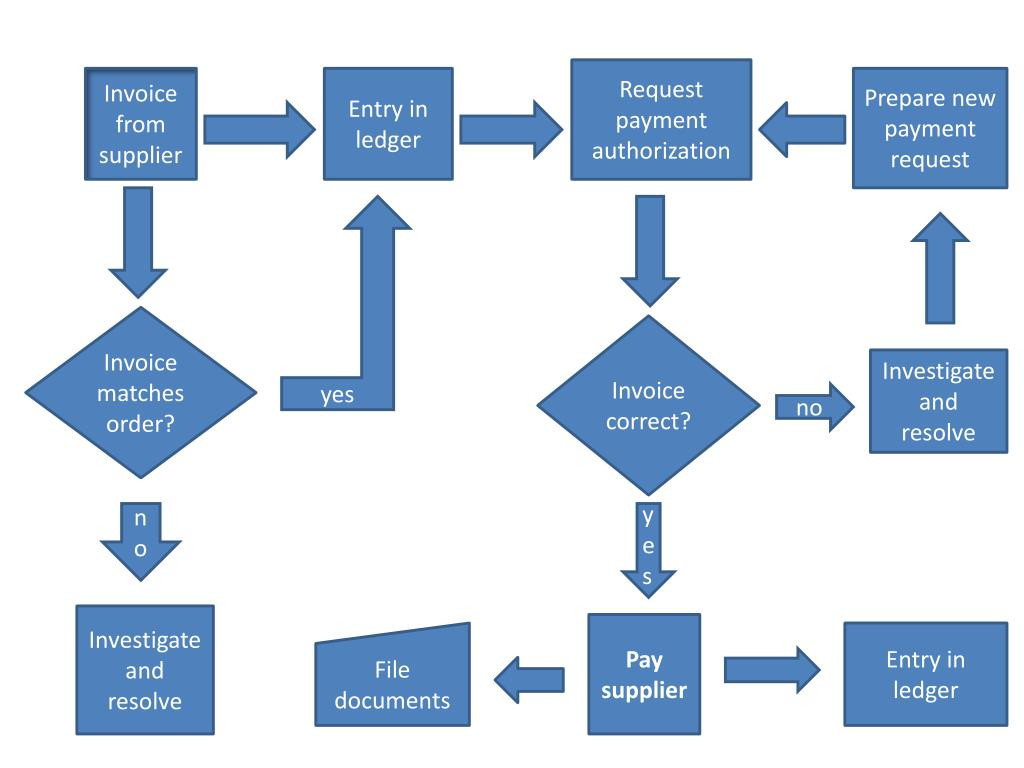

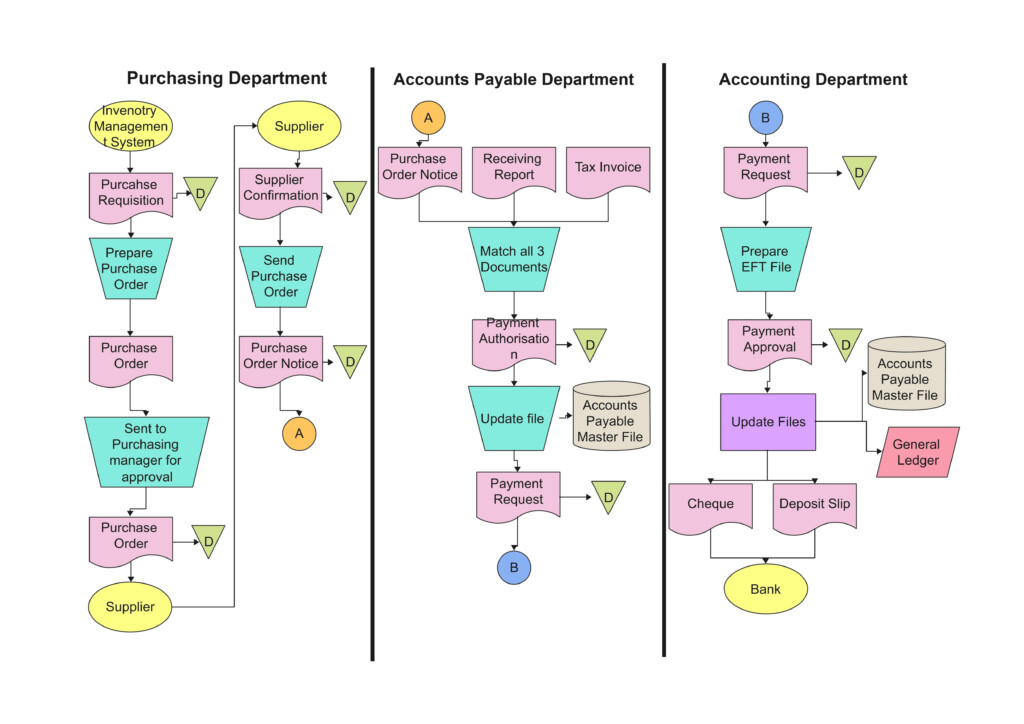

Accounts payable is a crucial aspect of any business’s financial operations. It involves the process of managing and recording all the company’s outstanding debts to suppliers and vendors. A flow chart of the accounts payable process helps to visualize and understand the steps involved in managing these financial obligations efficiently.

Typically, the accounts payable process starts with the receipt of an invoice from a supplier. The invoice is then matched with the purchase order and goods received note to ensure accuracy. Once verified, the invoice is approved for payment and entered into the accounting system for processing. The next step involves issuing payment to the supplier either through a check, electronic transfer, or credit card. Finally, the payment is recorded in the accounting system to update the company’s financial records.

Flow Chart Of Accounts Payable Process

Key Steps in the Accounts Payable Process Flow Chart

The flow chart of the accounts payable process can be broken down into several key steps. Firstly, the invoice receipt and verification process ensure that all invoices received from suppliers are accurate and match the goods or services received. This step helps to prevent errors and discrepancies in the payment process.

Next, the approval and payment processing step involve obtaining the necessary approvals from the relevant departments or individuals within the organization. Once approved, the payment is processed according to the agreed terms with the supplier. This step helps to ensure timely payments and maintain good relationships with suppliers.

Benefits of Using a Flow Chart for the Accounts Payable Process

Using a flow chart for the accounts payable process has several benefits for businesses. It helps to streamline and standardize the payment process, reducing the risk of errors and delays. By visualizing the steps involved in accounts payable, employees can easily understand their roles and responsibilities, leading to improved efficiency and productivity.

Furthermore, a flow chart of the accounts payable process can help identify bottlenecks or inefficiencies in the payment process, allowing businesses to make necessary improvements. This can lead to cost savings, improved cash flow management, and better financial control. Overall, implementing a flow chart for the accounts payable process can help businesses optimize their financial operations and achieve greater transparency and accuracy in managing their payables.

Download Flow Chart Of Accounts Payable Process

Accounts Payable Process Flowchart Flow Chart Bilarasa

Accounts Payable Process Flowchart Flow Chart Bilarasa

Accounts Payable Process Flowchart Flow Chart Bilarasa

Accounts Payable Process Flowchart Flow Chart Bilarasa