When it comes to securing a home loan, understanding the process flow chart can help streamline the application process and ensure a smooth experience from start to finish. Below, we outline the key steps involved in obtaining a home loan, from application to closing.

The first step in the home loan process is to complete an application with a lender. This typically involves providing detailed information about your income, assets, and debts, as well as authorization for the lender to pull your credit report. Once the application is submitted, the lender will review your financial information to determine your eligibility for a loan.

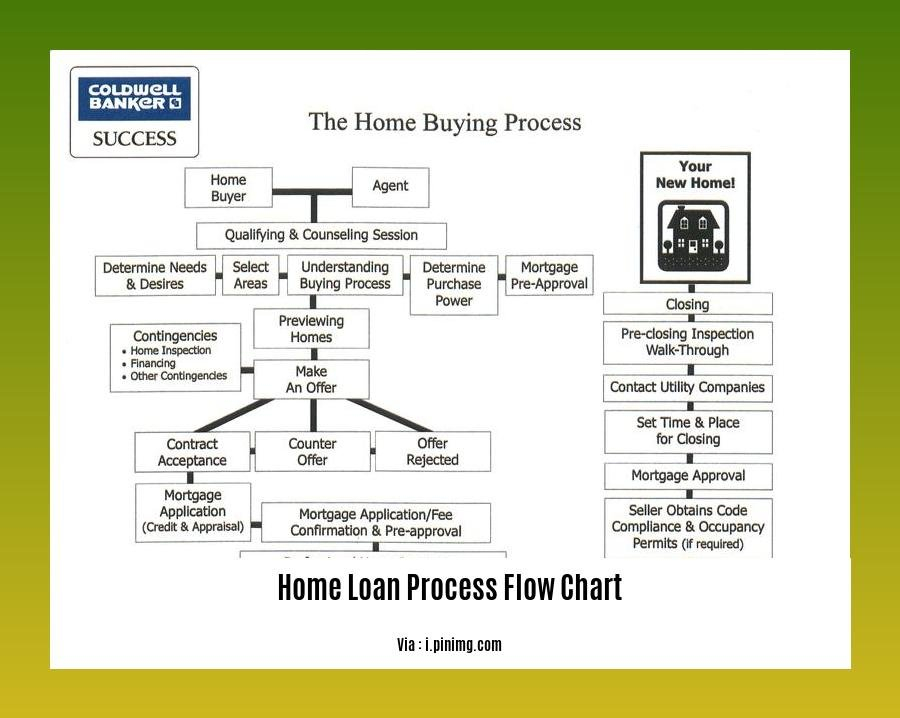

Home Loan Process Flow Chart

After the initial review, the lender may request additional documentation, such as tax returns, pay stubs, and bank statements, to verify your financial information. Once all required documents are submitted, the lender will issue a pre-approval letter, indicating the maximum loan amount you qualify for based on your financial profile.

Loan Processing and Underwriting

Once you have a pre-approval letter in hand, the loan processing and underwriting phase begins. During this stage, the lender will verify the information provided in your application and supporting documents to assess your creditworthiness and ability to repay the loan. This may involve ordering a home appraisal to determine the property’s value and ensuring it meets the lender’s requirements.

Following the underwriting process, the lender will issue a loan commitment letter, indicating that your loan application has been approved. This letter will outline the terms of the loan, including the interest rate, loan amount, and any conditions that must be met before closing. Once you accept the loan commitment, the closing process can begin, and you can move forward with finalizing the purchase of your new home.

By following the home loan process flow chart and working closely with your lender, you can navigate the home loan application process with confidence and ease. Remember to stay organized, respond promptly to any requests for information or documentation, and ask questions if you need clarification on any aspect of the process. With a clear understanding of the steps involved, you’ll be well on your way to securing the financing you need to purchase the home of your dreams.

Download Home Loan Process Flow Chart

Home Loan Process Flow Chart A Comprehensive Guide For Borrowers

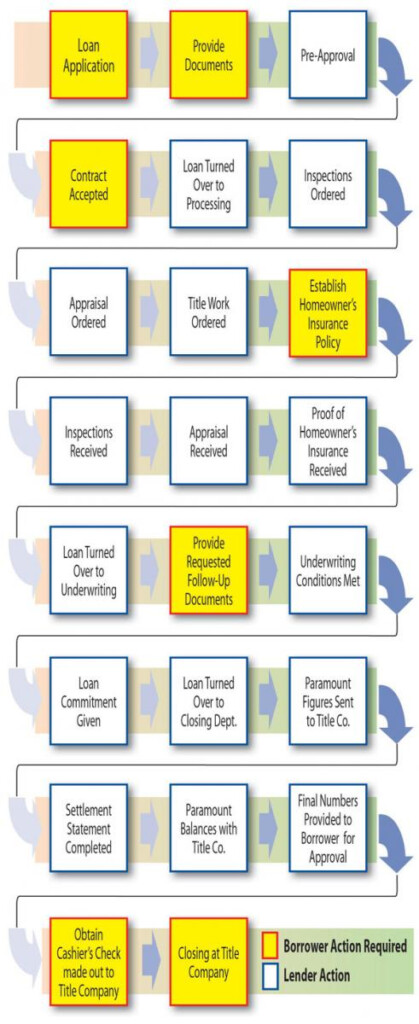

Loan Process Flow Chart

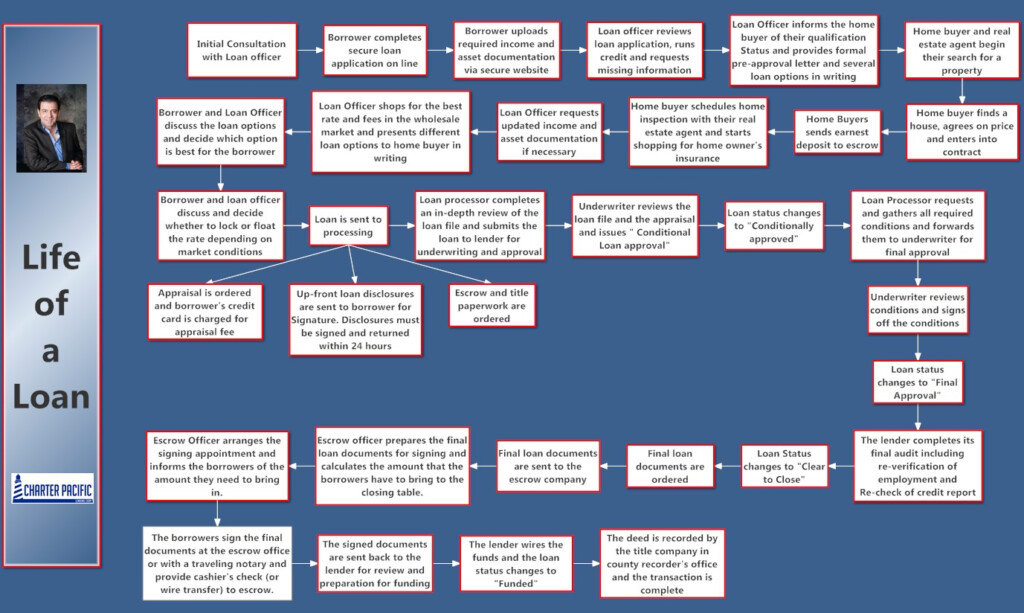

Loan Process Flow Chart

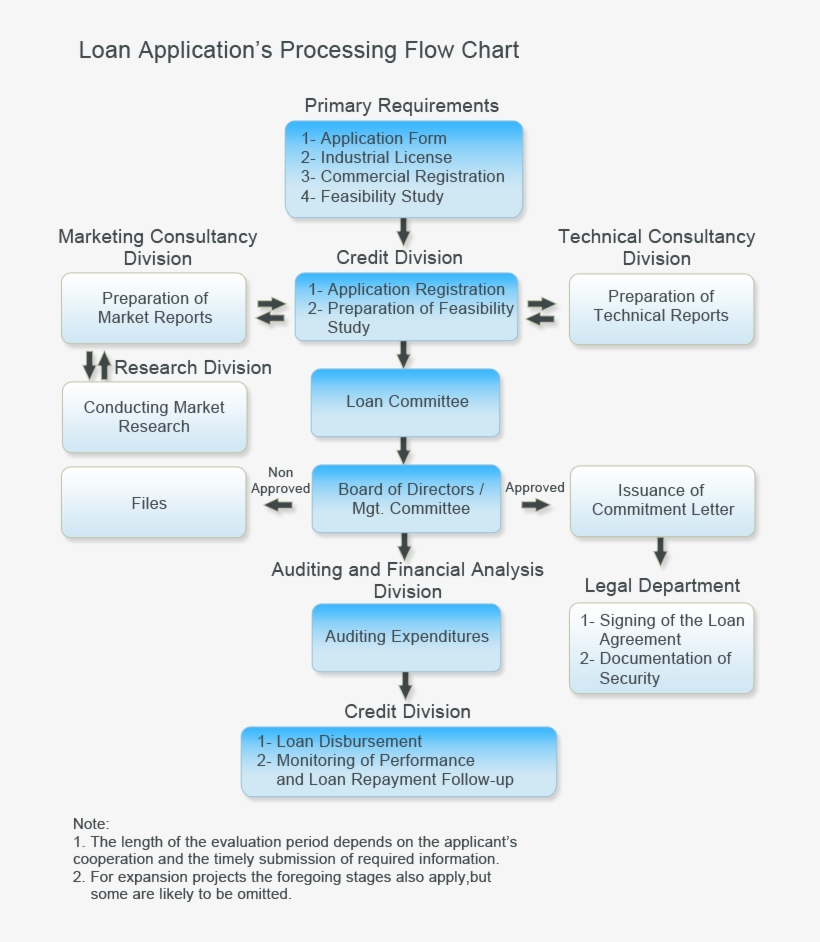

Loan Process Flow Chart